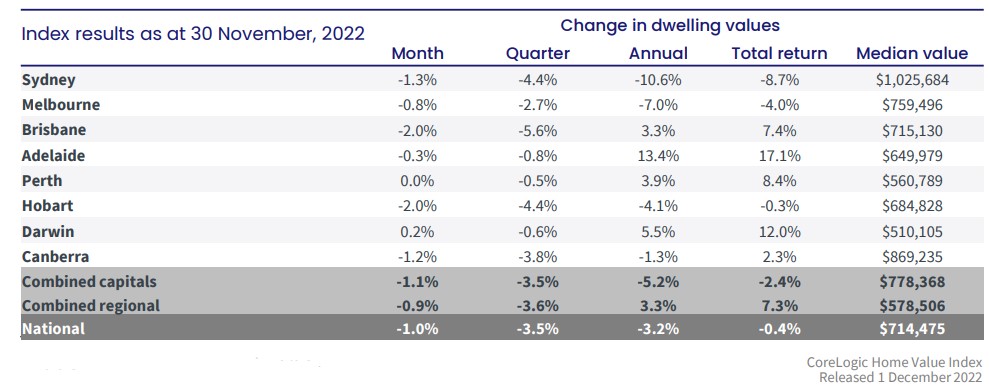

Dwelling prices recorded its seventh month of decline in November — the rate at which prices are dropping, however, continues to ease.

The CoreLogic Home Value Index finished the month with a 1% decline in median value, the smallest monthly drop since June.

CoreLogic research director Tim Lawless said the easing in the rate of decline is mostly coming from Sydney and Melbourne markets.

“Three months ago, Sydney housing values were falling at the monthly rate of 2.3% — that has now reduced by a full percentage point to a decline of 1.3% in November,” he said.

“Meanwhile, Melbourne home values were down 1.5% in July, with the monthly decline almost halving last month to 0.8%.”

The easing was also apparent in smaller capital cities and rest-of-state markets.

Mr Lawless said this could indicate that the initial uncertainty around buying in a higher interest rate environment is finally wearing off.

On top of this, the persistently low advertised property stock is also preventing any further acceleration in price declines.

“However, it’s fair to say housing risk remains skewed to the downside while interest rates are still rising and household balance sheets become more thinly stretched,” Mr Lawless said.

“There is still the possibility that the pace of declines could reaccelerate, especially if the current rate hiking cycle persists longer than expected.

State-by-state price situation

Across capital cities, Brisbane and Hobart led the monthly price decline, both recording a 2% drop.

On the other hand, only Perth and Darwin did not record declines, with the former maintaining its median value while the latter posting a 0.2% increase.

Mr Lawless said the Perth and Darwin markets are yet to record any signs of a material reversal in housing prices.

“A comparatively healthy level of housing affordability, along with tight labour markets and relatively strong economic conditions, have helped to insulate these cities from the downturn so far,” he said.

In terms of housing types, unit markets experienced a weaker decline in values at 0.6% compared to 1.2% for houses.

This was apparent throughout the downturn to-date, with capital city unit values down 4.7% from the recent peak, while house values are down 8.4%.

Every capital city apart from Hobart is recording a more resilient outcome for unit values relative to houses.

“This trend can at least partially be attributed to the more moderate gains recorded during the upswing, but probably also reflects the unit sectors more affordable price point at a time when borrowing capacity has reduced,” Mr Lawless said.

—

Photo by Frans van Heerden on Pexels.

Collections: Mortgage News

Share