Home Loan Cashback & Refinance Offers

Many lenders offer cash-in-pocket incentives for you to switch your loan over. Here’...

02 Feb, 2026

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

7.50% p.a. | 5.83% p.a. | $3,125 | Interest-only | Variable | $0 | $230 | 80% | Disclosure | ||||||||||||

7.15% p.a. | 7.23% p.a. | $3,377 | Principal & Interest | Variable | $0 | $250 | 80% | |||||||||||||

7.75% p.a. | 6.12% p.a. | $3,229 | Interest-only | Fixed | $0 | $220 | 80% | |||||||||||||

7.35% p.a. | 7.40% p.a. | $3,445 | Principal & Interest | Variable | $0 | $745 | 75% | |||||||||||||

8.77% p.a. | 8.80% p.a. | $3,654 | Interest-only | Variable | $0 | $300 | 85% | |||||||||||||

9.01% p.a. | 9.17% p.a. | $3,754 | Interest-only | Variable | $10 | $1,002 | 80% |

Selling your current residence before securing a new one can be daunting. But fear not. Bridging loans exist for this very reason.

A bridging loan can help 'bridge the gap' between buying your new home and selling your existing one, allowing a borrower to temporarily take on more debt to own both properties at once.

Typically, a person with a bridging loan won't need to make full repayments on the new debt during the bridging period. Instead, they may:

Once the sale is finalised, the proceeds go toward paying down the original mortgage, and the remaining balance rolls into a traditional home loan.

There are two types of bridging loans out there:

Closed bridging loans

For borrowers who already have a buyer lined up and a confirmed settlement date.

Open bridging loans

For borrowers who've found a new property but haven't yet secured a buyer for their current home.

Here's a step-by-step breakdown of how a typical bridging loan works:

The lender provides funds to buy your new property. If the bridging loan is with a new lender, your existing mortgage will usually need to be refinanced so both debts are held by the same provider.

This is the point of 'peak debt'. You owe the value of the new home plus the balance of your old mortgage.

The borrower will get to work selling their original property while continuing to meet their existing mortgage repayments and the interest repayments on the bridging loan (though sometimes these may be capitalised).

Once the original property sells, the borrower will pay back their original mortgage and use the remaining fund to pay down some of the bridging loan.

The left over balance will become a traditional mortgage and, hey presto, the borrower can rejoice in their new abode.

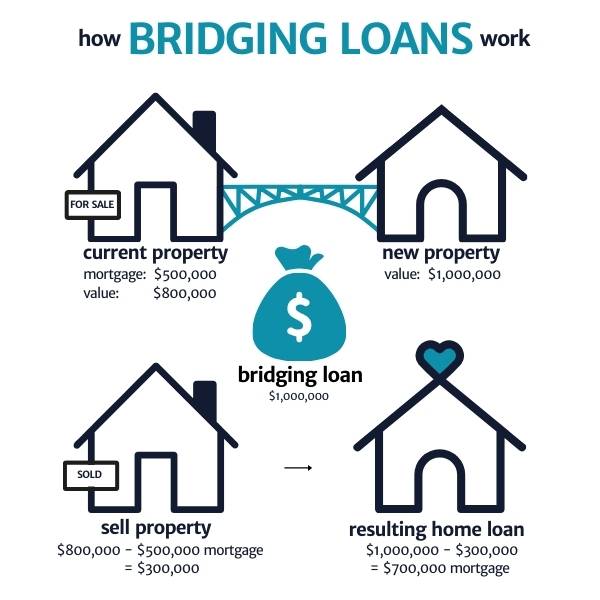

Suppose you still owe $500,000 on your current home, which you expect to sell for $800,000. You've found a new home worth $1,000,000.

Bridging loans aren't available to everyone. Lenders often require:

Comparing bridging loans is much like comparing traditional home loans, but with a few differences. Here are the key factors to keep an eye on:

Bridging loans typically come with higher interest rates than traditional mortgages, largely because they represent a greater risk to a lender. Afterall, many people taking on a bridging loan could be borrowing more than their normal capacity.

Comparison rates exist to highlight a general overview of the cost of a home loan, inclusive of interest and fees. A comparison rate that's notably higher than a product's interest rate could be a red flag.

Some providers offer an interest-free period in the early stages of a bridging loan or the option to forego repayments for a time. These could be handy options for particular borrowers.

Bridging loan products tend to demand loan-to-value ratios (LVRs) of 80% or less at the time of peak debt.

Bridging loans often come with strict conditions. Most are provided for terms of up to 12 months. In that time, the original property must be sold. If you don't or can't sell in that time, your lender might step in to speed up the process, whether that's in your best interest or not.

The lender that provides the bridging loan will be the one that holds the resulting mortgage going forward. If particular features - like competitive ongoing interest rates or local branches - are priorities, they should also be considered.

Buy before you sell with confidence

Bridging loans let you secure your next home without waiting for your current property to sell, reducing the risk of missing out.

Avoid interim accommodation and moving twice

You don't need to rent or arrange temporary housing while you wait to buy, which saves both stress and costs.

Flexible repayment options

Many lenders allow you to make interest-only repayments or even capitalise the interest, easing cash-flow pressure during the bridging period.

Smooth transition into a standard loan

Once your old property sells, the loan balance typically converts into a standard home loan.

Higher costs than regular mortgages

Interest rates and fees on bridging loans are often higher, and capitalised interest can add up quickly.

Short timelines and strict conditions

Bridging terms usually max out at 6 to 12 months. If you don't sell within that period, the lender may enforce a sale or refuse an extension.

Peak debt pressure

At one point, you'll owe a large part of the value of both homes combined. Even if it's temporary, this can be daunting and may stretch your borrowing capacity.

Uncertain market conditions

If your home sells for less than expected, you'll have less equity to reduce the bridging debt. That can leave you with a larger ongoing mortgage than planned and could push your LVR above 80%, possibly triggering Lenders Mortgage Insurance (LMI).

Fewer choices

Bridging loans require careful planning, and not every lender offers them - meaning you may have fewer choices than with a standard mortgage.

Bridging finance may not be the only option available to you. You might want to also consider:

Negotiating a longer settlement

If you're confident you can sell your current property quickly, you might ask the seller if they mind pushing back the settlement date to allow for you to do so.

Subject-to-sale contracts

You could also submit an offer that's 'subject-to-sale'. If accepted, your purchase won't go through until you sell your current property.

Rent your current or new property for a period

You might ask the person buying your property or selling the new property if they'd mind providing a short lease agreement to get you over the line.

Refinancing your existing home loan to access equity

If you have enough equity to own both homes simultaneously, but not enough cash on hand, you might be able to refinance your home loan to access some wealth.

Taking out a second standard home loan

If you have enough equity or a sizeable deposit, you could take out a second home loan rather than a bridging loan.

Consider a construction home loan

Looking for a financing solution to fill a gap between selling one property and moving into one that's still under construction or being renovated? A construction home loan might be worth considering.

Delaying purchase until after selling for reduced risk

Selling before buying could present a simpler solution, but might mean finding temporary accommodation in the meantime.

Many banks and lenders offer bridging loans, including some of the big four banks.

Here is a non-definitive list of banks and lenders that advertise bridging loans:

While you don't normally need a cash deposit to get a bridging loan, you'll generally need enough equity in your current home to act as security.

For instance, if you have a house worth $500,000 and a $300,000 mortgage, you have $200,000 of equity that can be used to help secure a bridging loan.

Most bridging loan lenders require borrowers to have an LVR of 80% or less at the time of peak debt.

Once your current property sells, the proceeds will be used to pay off your existing mortgage and reduce the bridging loan balance.

Any remaining balance on the bridging loan will then be rolled into a traditional home loan.

At that point, you'll only have one mortgage to manage.

To be eligible for a bridging loan, you'll typically need to meet a lender's standard home loan criteria, plus hold enough equity in your current property.

Lenders will look at your income, credit history, and the value of your existing property compared to the new one when determining your eligibility.

Most bridging loans have terms of 6 to 12 months. If your home hasn’t sold by then, you might be able to request an extension, though approval isn’t guaranteed and may come with extra fees or higher interest.

If an extension isn’t granted, the lender may require you to switch to a full repayment structure or even force the sale of your property – even if that means selling for below market value. It’s important to have a realistic sale timeline and contingency plan before committing to a bridging loan.

Bridging loans can be more expensive than traditional home loans due to their higher interest rates, which are often 1% to 3% above standard mortgage rates. This reflects the higher risk to lenders, as you’ll temporarily own two properties.

However, during the bridging period, borrowers typically only need to repay the accruing interest. Some lenders even allow the interest to accrue without payment until the bridging loan is rolled into a traditional home loan.

This means your repayments during the bridging period are likely to be smaller compared to those demanded by an equivalent-sized traditional home loan.

If your current home sells for less than you anticipated, the shortfall reduces the equity you can put toward your new loan. That means your end debt (the mortgage remaining on your new property after the sale) could be higher than planned. For example, if you expected $500,000 from the sale but only received $450,000, you’d have $50,000 less to pay down the bridging loan, and your ongoing mortgage would be larger.

If the end debt pushes your loan-to-value ratio (LVR) above 80%, you may also be required to pay Lenders Mortgage Insurance (LMI) or restructure your loan.

Looking for a specific Home Loan Provider? Explore the brands we compare to see a list of their products, rates and features.

Not sure which type of loan is best for your needs?

Your Mortgage can help you find out.