New research from HtAG Analytics showed an alarming finding about housing affordability — Australians would need to spend up to 140 years paying off a home.

The study estimated the number of years it would take for homeowners to fully repay their home loan based on median home prices and median family income levels.

Here are some suburbs highlighted in the study and the number of years it takes for homebuyers in each to pay down a typical mortgage for houses or units.

- Strathfield, New South Wales – 144 years (Houses)

- Gerroa, New South Wales – 134 years (Houses)

- Chinderah, New South Wales – 124 years (Houses)

- Sunshine Beach, Queensland – 120 years (Houses)

- Soldiers Point, New South Wales – 82 years (Units)

- Noosa Heads, Queensland – 75 years (Units)

- Byron Bay, New South Wales – 74 years (Units)

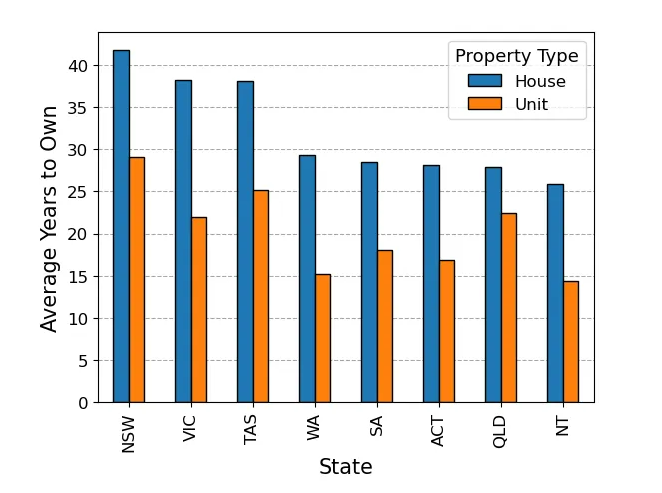

Meanwhile, the chart below shows the average time it takes for homebuyers in each state to settle their mortgages.

As indicated above, New South Wales, Victoria, and Tasmania are the three states where homeowners tend to spend the highest number of years to repay their home loans for houses.

For units, New South Wales, Tasmania and Queensland had the highest “years to own”.

In some states like South Australia and Queensland, the gap between owning a house and a unit is relatively smaller, reflecting a more balanced property market.

What’s driving the worsening affordability?

HtAG Analytics co-founder Alex Fedoseev said the unaffordability of many suburbs has become even worse in the last three years.

“Over the years researched, the composition of suburbs in the top 10 least affordable markets has shifted due to various factors,” he said.

“As house prices rose and then fell while interest rates increased during the same period, Sydney suburbs have become more dominant in the list of least affordable markets.”

For instance, the number of years to pay off a home loan in Strathfield, New South Wales ballooned from 84 years to 144 years within the span of three years.

“Suburbs with high ‘years to own’ values are likely to experience downward pressure on house prices, as locals may struggle to afford purchasing houses as prices rise and incomes lag,” Mr Fedoseev said.

“However, there are other market variables that may still push the prices up even in low affordability markets.”

The latest affordability report from the Real Estate Institute of Australia (REIA) covering March 2023 quarter showed that the proportion of income required to meet the average loan repayment in the country increased to the highest level since September 2008.

There are common factors that contribute to the consistent unaffordability of suburbs in such markets — high house prices, prevalence of renters, and exclusive locations with generational wealth.

“In such markets, a significant portion of the population is engaged in renting units rather than owning a house — while the majority of household incomes in these suburbs may suffice for renting or owning a unit, they may not be adequate for purchasing houses,” he said.

“This leads to a property market that primarily supports rental properties in units and maintains high house prices.”

Meanwhile, many prime suburbs near the water or in upscale locations attract a population with well-established, generational wealth.

“In these areas, wealth often outpaces wage and income growth for the general population,” he said.

“The high demand for premium real estate from affluent residents drives up prices, making it challenging for individuals with lower or average incomes to afford houses in these neighbourhoods.”

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.29% p.a. | 5.33% p.a. | $2,773 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.19% p.a. | 5.10% p.a. | $2,742 | Principal & Interest | Variable | $0 | $0 | 80% |

| Disclosure | |||||||||||

5.39% p.a. | 5.43% p.a. | $2,805 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure |

-

Photo by Elnur on Canva.

Collections: Mortgage News Mortgage Repayment Buying a home

Share