In this post:

- What is mortgage stress?

- How many people are in mortgage stress in Australia?

- What causes mortgage stress?

- How to tell if you’re in mortgage stress?

- Ways to avoid mortgage stress

- In mortgage stress? Where to seek help

For many Australian households, the single biggest expense can be their home loan repayments. But when your mortgage is taking up more and more of your income, you might find yourself in 'mortgage stress'.

By definition, mortgage stress often means spending 30% of income on repayments. More broadly, what is considered mortgage stress is when meeting mortgage payments and household bills becomes difficult

A household is generally considered to be in mortgage stress if it's spending 30% or more of its combined pre-tax income on mortgage repayments. But the figure is not a hard-and-fast rule in financial circles.

By more general measures, households are considered to be in mortgage stress when they find it difficult to meet their mortgage repayments and pay their other regular bills. This can happen with a shift in the ratio of income to loan repayments and/or other household expenses.

Lower income households tend to be at greater risk of mortgage stress where any squeeze in that ratio can be far more critical in dollar terms.

See also: How much of your income should you spend on a mortgage?

Official measures show how mortgage depression can impact households when repayments take up too much income

The Australian Housing and Urban Research Institute (AHURI) recognises that measuring mortgage stress is far more complex than the 30% mortgage-to-income test.

AHURI notes it doesn't take into account households who may choose to be paying more into their home loans for longer term benefits, nor does the ratio apply across all income levels. For example, 30% removed from a high income can still leave more than sufficient funds to pay for other expenses, including discretionary spending.

Research company Roy Morgan has been measuring mortgage stress in Australia since 2007. It uses a far more complex formula and considers a person at risk of mortgage stress if between 25% and 45% of their pre-tax household income is going towards mortgage repayments, based on income levels and spending.

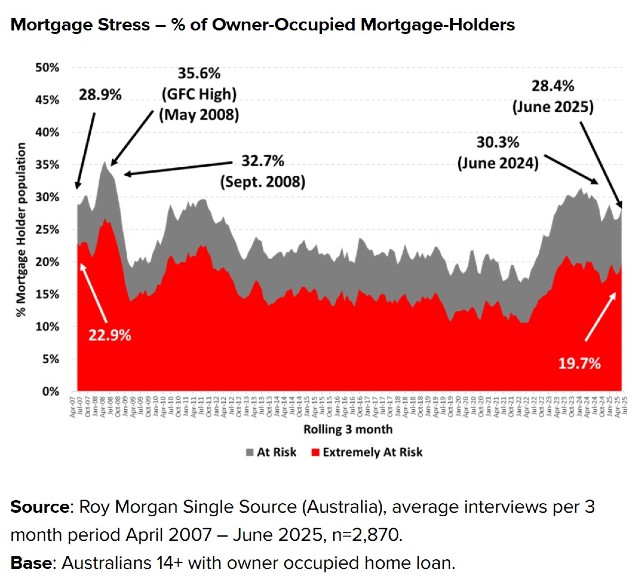

Here's a graph showing the rates of mortgage stress in Australia's recent history:

According to the data, mortgage stress was highest during the height of the Global Financial Crisis (2007-2008), rising again in the post-pandemic period amid climbing inflation and interest rates.

How many people are in mortgage stress in Australia?

Recent Roy Morgan data shows there has been an easing in the 'Extremely at Risk' category (18.5% down from 19.7%) in the year to June 2025 but that reduction is limited to households with higher incomes. It found lower-income households have not experienced the same relief.

The recent downturn in overall mortgage stress has been attributed to easing inflation, income tax cuts, the lowering of home loan interest rates, and a rising share market.

However, the research shows mortgage stress has increased among those in the lowest two income brackets due to slower income growth and falling full-time employment.

Mortgage stress among Australian families

For many Australian families, mortgage stress means more than just high repayments - it can affect their whole lifestyle. Mortgage stress typically occurs when over 30% of household income is directed towards home loan repayments. Families with children or dependents may be hit hardest as their budgets are often stretched across schooling, childcare, groceries, and everyday expenses.

Here's what the data says:

- In 2024-25, 44.5% of households with a mortgage spent more than 30% of their disposable income on housing costs

That's according to analysis by the Australian Institute of Health and Welfare considering PolicyMod data from the Australian National University's Centre for Social Policy Research.

- More than 1.4 million Australian home loan holders were considered 'at risk' of mortgage stress as of mid-2025 - Roy Morgan research found

When mortgage stress rises, households may choose to cut back on essentials like food, healthcare, or schooling. It's not just about the numbers, it's about the trade-offs families are forced to make. For example, a dual-income household earning $120,000 after tax may spend over $38,000 a year (32%) on mortgage costs alone, before groceries, utilities, or essential bills, and they generally have little control over that figure.

Mortgage stress for older Australian workers

Older Australians in their 50s and 60s can face unique pressures when carrying mortgage debt. Unlike younger borrowers, they often have less time before retirement to repay loans. Many may still be paying off their mortgage later in life due to rising property prices and longer loan terms.

Key insights:

- Around 43% of Australians aged 55-64 were still paying off a mortgage in 2021, according to Census data

That number drops to 13% of 65-74 year olds, and 4% of those aged 75+.

- A 2019 AHURI report highlights mortgage debt among older households has risen sharply in recent decades

This has left many vulnerable to interest rate changes and income shocks.

For older workers, mortgage stress can mean delaying retirement, downsizing earlier than planned, or relying on superannuation to cover repayments. The key challenge is that income stability and health risks become more pressing, leaving fewer options if stress builds.

Mortgage stress among first-home buyers in Australia

First-home buyers are often the most exposed to mortgage stress because they borrow at higher loan-to-value ratios (LVRs), have smaller savings buffers, and face higher monthly repayments relative to income. With property prices and interest rates rising, this group finds it harder to manage repayments, especially in the first few years of ownership.

Recent findings:

- Mortgage stress has risen sharply for first-home buyers, with many requiring over 50% of their income to service loans on entry-level homes in major cities, according to Domain's 2025 First-Home Buyer Report

First-home buyers are among the most sensitive to financial shocks as they generally have large outstanding loan balances comparative to incomes. Thus, many struggle to keep their head above water when rates climb.

What causes mortgage stress?

Households can be pushed towards mortgage stress through no control of their own. It can occur when:

- Variable interest rates are hiked

- Other expenses increase, or new expenses are added

- Inflation causes the cost of goods and services to rise

- Household income is reduced through employment changes, sickness, etc.

Typical mortgage stress symptoms include dipping into savings, asking for help with bills, or worrying about the next repayment — here’s how to tell if you’re in mortgage stress

Different people have different measures of financial discomfort but in simple terms, if you feel you're regularly struggling to meet your mortgage repayments, there's a good chance you're in mortgage stress.

This could be the case even if your mortgage repayments are less than 30% of your gross income but it pays to do the calculation to understand where you stand against the general benchmark.

If you think you might be in mortgage stress, you should ask yourself:

- Are you regularly dipping into your savings to pay for everyday expenses?

- Are you contributing anything to your savings at all?

- Are you regularly asking family or friends for help to cover your bills?

- Are you worried about how you're going to make your next home loan repayment?

Mortgage stress generally occurs before a home loan falls into arrears or default. If you fear it's just a matter of time before this happens, here are some steps you can take.

Ways to avoid mortgage stress

Some steps of avoiding mortgage stress are easier to take than others, but let's consider all the alternatives.

1. Increase your income

It seems an obvious place to start, but increasing your income could alleviate some of your financial burdens, and there are a number of ways you can do this. You can reconsider your current employment and look around for a better paid role, take on extra work, start a side hustle, or rent out a spare room or storage space. It may also mean looking at opportunities for additional training or taking on a specialisation that may boost your earning potential.

2. Review your budget

If you don't have a budget, then making one is a vital first step to help you get a clearer picture of exactly where you stand. By evaluating all your incomings and outgoings, you may identify opportunities to cut back on some non-essential expenses. Obvious changes may leap out at you as you go through the exercise.

3. Revisit your home loan

When you've done all you can to cut your unnecessary or excessive expenses, it's time to look at your home loan. In any case, it's wise to reassess your mortgage every couple of years to check that it's still the best loan for you, is competitive compared to others in the market, and provides the features you need.

As a first step, you should speak to your lender to see what you can do to ease the financial burden of meeting your home loan repayments, even if it's just a temporary fix to keep you from defaulting on your loan. Some options are:

- Reducing your repayments You could change the frequency of your repayments or swap to interest only (IO) repayments in order to reduce your repayments.

- Accessing any extra funds in your loan If you have money available to you in either an offset or redraw facility, it could be time to access it to help you repay your home loan.

- Restructuring the loan This may mean moving from a variable to a fixed rate, or vice versa, or splitting your loan in a bid to bring your regular repayments down. It could also mean extending your loan term if that's an option.

Bear in mind, these alternatives will likely cost you more in interest in the long run and could attract additional costs and fees. You'll need to take these into account when you determine whether a restructure will benefit you.

4. Refinance your home loan with another lender

If there are simply better home loans on the market than the one you hold, it may pay to refinance to take advantage of a lower interest rate. Refinancing can save you money on your mortgage repayments in the long term, but it will likely cost you in the short term. You'll also need to be certain any reduction in repayments is going to be worth the cost of refinancing.

As a general rule of thumb, it may not be worth refinancing your home loan unless your interest rate drops by at least 0.5% to 1% p.a., with some experts claiming 2% p.a. is the magic number, but everyone's circumstances will differ. Sometimes it may be worthwhile to refinance to a loan offering features better suited to your financial needs. The table below features some of the most competitive refinancing interest rates on the market:

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.29% p.a. | 5.33% p.a. | $2,773 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.19% p.a. | 5.10% p.a. | $2,742 | Principal & Interest | Variable | $0 | $0 | 80% |

| Disclosure | |||||||||||

5.39% p.a. | 5.43% p.a. | $2,805 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure |

Some lenders may also offer special refinance incentives, such as cashback offers, to offset some of the costs of taking out a new home loan. These may come with conditions attached and sometimes only extend to certain mortgage products, so you'll need to consider whether refinancing to achieve lower mortgage repayments will be the best move over the longer term as well.

5. Downsize your home

If you're struggling to pay the mortgage on your home, you might need to ask yourself whether it would be better for your circumstances to downsize. Downsizing doesn't necessarily mean moving into a smaller home, although that is one alternative. It could also mean selling the property you have and buying in a more affordable area. In some cases, you may be able to afford a larger property in another location.

If you've built up some equity in your current property, selling it means that equity could go towards a down payment on a less expensive home. This will not only reduce the size of the home loan you need (and therefore, your mortgage repayments) but may also effectively increase the size of your deposit, potentially securing you a lower interest rate as well.

Selling your home may seem like a big step to take and there are many variables to consider if you're thinking of going down this path. Again, there will be costs involved with selling one property and buying another, but downsizing can be an effective long-term solution to counter mortgage stress.

In mortgage stress? Where to seek help

If you feel you could be in mortgage stress - or in danger of falling into it, it's wise to seek financial counselling to help you understand what options may be open to you before you find yourself in a desperate situation. There are several organisations in Australia that offer free help and can assist in getting you into a better financial position. Here are a few:

|

Organisation |

Service |

Website |

|---|---|---|

|

National Debt Helpline |

Free financial counselling |

|

|

MoneySmart (ASIC) |

Government advice and mortgage stress calculator |

|

|

Salvation Army Moneycare |

Free community financial counselling |

|

|

UnitingCare |

Free financial counselling and support |

|

|

CatholicCare |

Community support and financial counselling |

First published in November 2024

Collections: Refinance home loans Mortgage Repayment

Share