More first-home buyers in New South Wales will be able to qualify for stamp duty exemptions and concessions under the new legislation to be introduced into Parliament this week.

Changes to the First Home Buyer Assistance scheme will see the threshold for stamp duty exemptions increase from $650,000 to $800,000.

Stamp duty concessions, on the other hand, will have a threshold set from $800,000 to $1m.

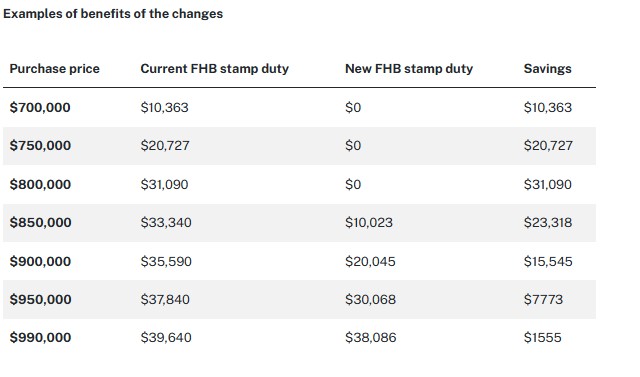

With the changes, first-home buyers purchasing a property at $800,000 will save up to $31,090.

Another change will be focused on increasing the requirement to live in the home from 6 months to 12 months, in an effort to improve the integrity and targeting of the scheme.

Around 84% of future first-home buyers (or around five in six) will pay no tax or pay stamp duty at a reduced rate starting 1 July 2023.

NSW Premier Chris Minns said this is a fairer and simpler system to ensure more first-home buyers are able to have an opportunity to enter the market.

“I understand the stress of trying to purchase your first home. I want more singles, couples and families realising this dream,” he said.

Meanwhile, the legislation will include grandfathering provisions that will ensure that first-home buyers who opted into the annual property tax can continue to pay that tax until they sell their property.

This means that the government will close off access to the former government’s First Home Buyer Choice (FHBC) scheme on 1 July 2023.

NSW Treasurer Daniel Mookhey said these policy changes will deliver the most help to the first home buyers most at risk of leaving the housing market all together as interest rates go up.

“The new thresholds for stamp duty exemptions and concessions are a simpler and fairer way to help more first home buyers than the property tax, which helped a smaller cohort of first home buyers,” he said.

The table below shows how much first-home buyers will be able to save under the new rules:

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | LVR | Lump Sum Repayment | Additional Repayments | Split Loan Option | Tags | Features | Link | Compare |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

6.04% p.a. | 6.06% p.a. | $2,408 | Principal & Interest | Variable | $0 | $530 | 70% | Featured Online ExclusiveUp to $4k cashback |

| |||||||||

5.99% p.a. | 5.90% p.a. | $2,396 | Principal & Interest | Variable | $0 | $0 | 80% |

| ||||||||||

6.14% p.a. | 6.16% p.a. | $2,434 | Principal & Interest | Variable | $0 | $250 | 60% |

| ||||||||||

5.95% p.a. | 5.95% p.a. | $2,385 | Principal & Interest | Variable | $0 | $0 | 90% | |||||||||||

5.94% p.a. | 5.95% p.a. | $2,383 | Principal & Interest | Variable | $0 | $0 | 90% |

-

Photo by Andrii Yalanskyi on Canva.

Collections: Mortgage News Buying a home

Fact checked

Fact checked

Share