Budget Direct revealed the suburbs with the highest number and biggest concentration of old homes in Australia.

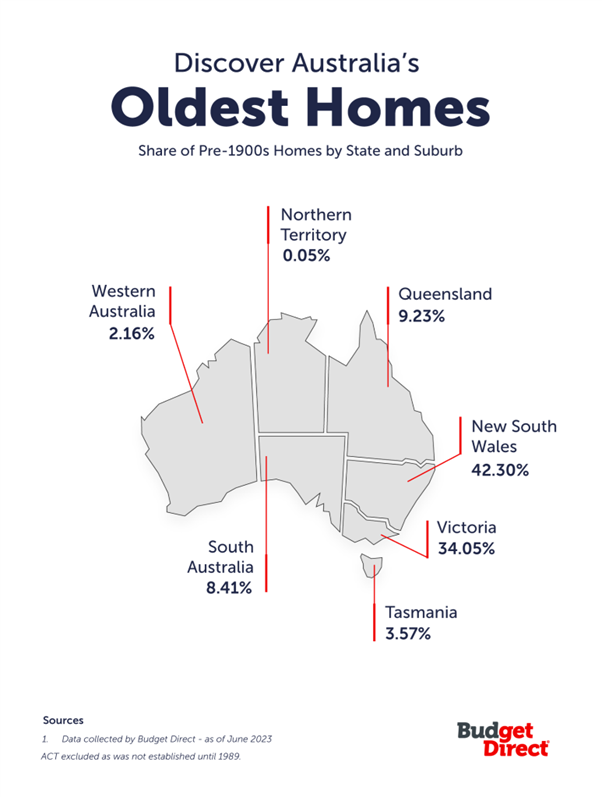

According to the data as of June 2023, New South Wales has the greatest share of pre-1900s homes at 42.30%, followed by Victoria (34.05%).

Share of Pre-1900s homes by state

Budget Direct’s chief growth officer Jonathan Kerr said New South Wales’ suburb of Paddington has the largest share of old homes in the state at 2.39%.

“The Sydney suburbs of Newtown (1.58%), Surry Hills (1.37%), Balmain (1.29%) and Redfern (1.14%) round out the top five for Australia’s biggest city.”

While New South Wales might have more old homes, Queensland has the suburbs with the highest concentration of aged houses — in fact, six of the top 10 suburbs in Australia with the oldest average home age are found in Queensland.

However, it is the South Australian suburb of Torrensville that has the oldest homes on average — the average age of homes in this suburb is 87.8 years old.

Oldest Homes by Suburb and State

|

Suburb and State |

Average Home Age (in years) |

|

Torrensville, SA |

87.8 |

|

Ipswich, Qld |

82.6 |

|

East Geelong, Vic |

81.1 |

|

East Toowoomba, Qld |

79.3 |

|

Clovelly, NSW |

78.0 |

|

East Ipswich, Qld |

72.8 |

|

Mount Morgan, Qld |

72.8 |

|

Ascot Vale, Vic |

71.0 |

|

Gordon Park, Qld |

70.9 |

|

Ascot, Qld |

69.2 |

Mr Kerr said owners and buyers of old homes must take note of the right insurance that would protect them,

“We’ve all heard the phrase the older the better. Well in this case we certainly acknowledge that homes in these suburbs have stood the test of time,” he said.

“It’s worth noting that the age of a property can have a bearing on home insurance, and that’s why it’s important to know if your home is classified as a heritage-listed dwelling as this may have an effect on insurance protection cover.”

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.29% p.a. | 5.33% p.a. | $2,773 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.19% p.a. | 5.10% p.a. | $2,742 | Principal & Interest | Variable | $0 | $0 | 80% |

| Disclosure | |||||||||||

5.39% p.a. | 5.43% p.a. | $2,805 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure |

-

Photo by pamspix on Canva.

Collections: Mortgage News Property News Insurance Buying a home

Share