Australia’s affordability seemed to have reached its worst level since 2011, with the latest affordability index showing signs of deterioration prior to the Reserve Bank of Australia (RBA)’s rate hike in May.

Bluestone Home Loan’s latest affordability index came in at 97.9% over the three months to April 2022, a sharp rise from the long-term average of 87.3 — a higher index reading indicates a higher proportion of average income required to service an average home loan.

The index is currently tracking at its highest point since November 2011 and has continued to track above the long-term average over 11 consecutive rolling quarters.

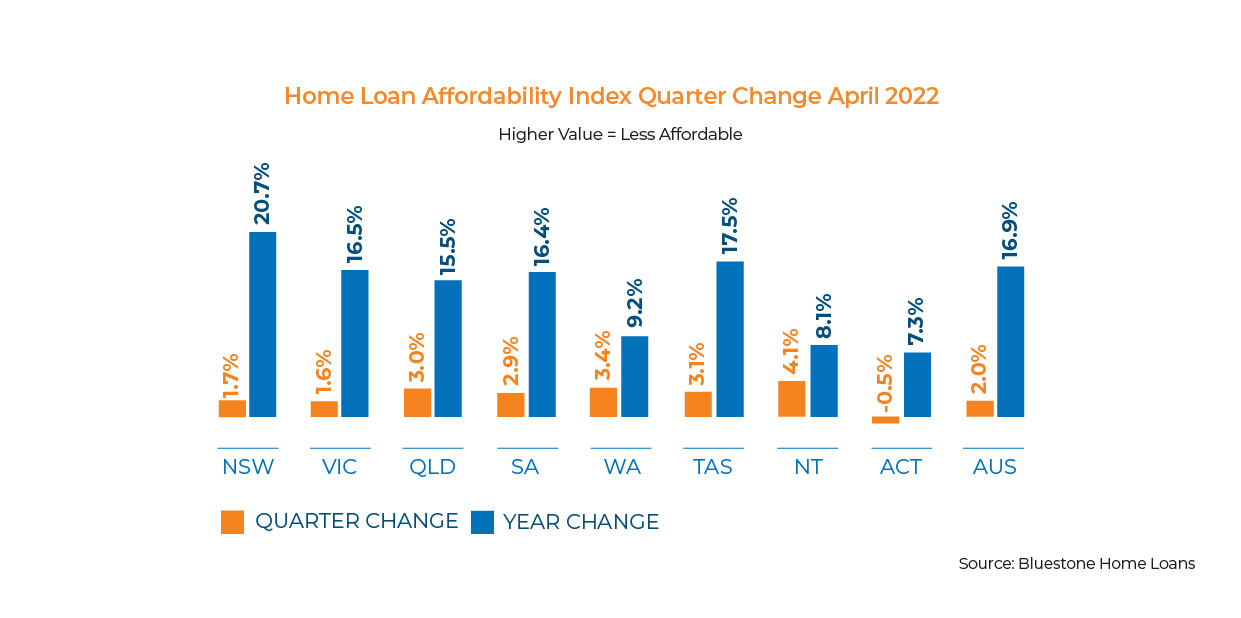

All states reported declines in affordability over April except ACT, where there was a marginal improvement.

New South Wales remained the most unaffordable state due to the high-priced Sydney housing market. Tasmania and Victoria also posted steep declines in affordability during the period.

Bluestone Home Loans consultant economist Dr Andrew Wilson said the above-average affordability index readings indicate the clear prospect of continuing easing of house price growth and declining home loan activity.

“Strong home price growth over 2021 and into 2022 has resulted in buyers borrowing more to keep pace with markets — higher loan amounts, coupled with subdued wages growth, has resulted in a higher proportion of buyer incomes required for loan repayments,” he said.

“Strict lending conditions from financial institutions, however, place a ceiling on borrowing capacity that can sideline buyers and result in reduced demand and lower prices growth.”

While house prices appear to have already stabilised in some markets and are now heading to a downtrend, Dr Wilson said a continuing easing of home lending activity from the 2021 peaks can be expected through 2022.

“Home loan affordability will be impacted by rising interest rates although offset by the positives of a strong economy generating rising wages,” he said.

Rate hikes amid winter selling season

The RBA has already hiked the official cash rate from its historic lows of 0.1% to 0.85% in just two months — this would likely be reflected in the home loan affordability data during the winter selling season.

“Higher interest rates have a negative impact on housing affordability, however, higher borrowing costs for existing mortgage holders and home buyers will be offset in the shorter-term by a strong, full employment economy with low unemployment rates and rising wages, record-level savings rates, the wealth effect of recent significant home price growth and the 3% repayment buffer imposed by banks on new borrowers,” Dr Wilson said.

Despite the expected impact of the rate hikes on housing demand, Dr Wilson said the return of mass migration, the surge in international students, and the series of new policies for buyers would help buoy the overall demand.

Furthermore, the under-supply in the housing and rental market could potentially encourage more property investors to participate.

“The clear prospect of a continuation of interest rate increases through 2022 as indicated by the RBA will however continue to impact home loan affordability despite an easing in house price growth levels, with home buyers set to pay more for their mortgages,” Dr Wilson said.

“Home loan activity, although currently remaining close to recent record results, can be expected to decline reflecting fragile market confidence and the onset of the quieter winter selling season.”

—

Photo by @benchaccounting on Unsplash.

Collections: Mortgage News

Share