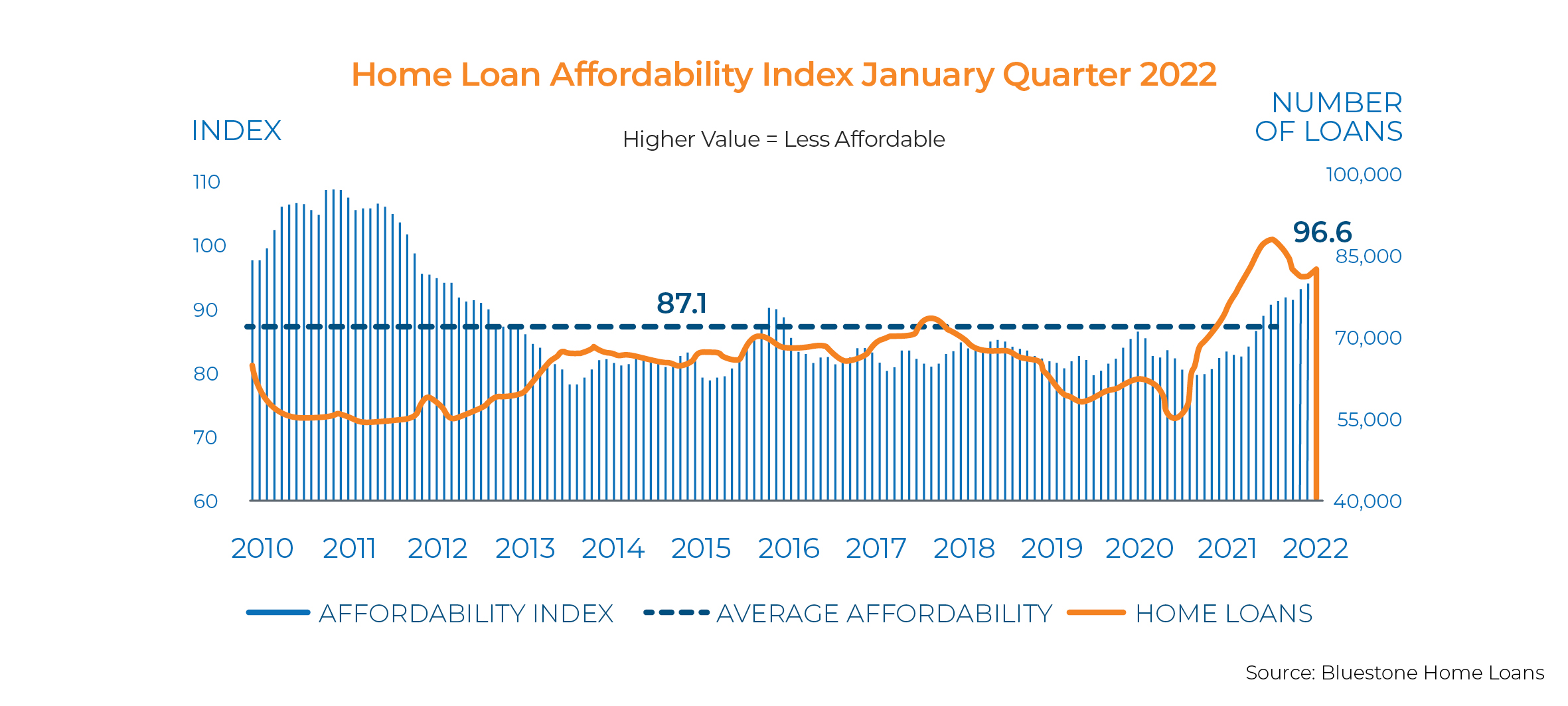

The ability of Australians to service their home loans worsened at the beginning of the year, at a level that appears to be accelerating.

Bluestone Home Loan’s latest report showed that the affordability index increased to 96.6 in January.

The index rose faster in January with a 2.2% growth compared to December when the index reflected a 1.5% gain.

The higher the index reading, the higher the proportion of household income needed to service a mortgage.

Bluestone Home Loans consultant economist Dr Andrew Wilson said the house price growth over 2021 and into 2022 has resulted in buyers borrowing more to keep pace with markets.

“With subdued incomes growth and flat interest rates, this resulted in a higher proportion of buyer incomes required for loan repayments,” he said.

All state reported a decline in affordability, with the ACT reporting the steepest decline, followed by South Australia and Victoria.

CoreLogic figures in January showed that median price in Canberra rose by 1.8% to $1.03m for houses and by 1.3% to 594,992 for units.

Canberra is one of the cities besides Sydney and Melbourne where houses had a median price of above $1m during the month.

Despite the declines in other states, New South Wales remained the most unaffordable, with its index outpacing the national reading.

In Sydney, houses had a median price of $1.4m in January while units had a median value of $837,640.

Dr Wilson said the strict lending conditions from financial institutions would place a ceiling on borrowing capacity, which could, then, sideline buyers and result in reduced demand and lower prices growth.

“Flattening prices growth in the previous high-flying Sydney and Melbourne housing markets reflect significant declines in affordability over the past year, restraining the capacity of buyers to bid up prices,” he said.

“Lower prices growth will act to stabilise the decline in underlying home lending activity that has emerged over 2021 — continuing low interest rates, the easing of covid restrictions and concerns, a reviving national economy and the imminent return of mass migration will also support solid home lending through 2022.

Risky mortgage rising

Latest data from the Australian Prudential Regulation Authority (APRA) showed that around 24.4% of new residential loans lodged over the December quarter had debt-to-income ratios of six times or higher, up from 23.8% in the previous quarter.

The data also showed that the growth in new mortgages to investors outpaced that of owner-occupiers, with the former now comprising 30.4% of the new commitments in December.

In October last year, APRA revised its guidance on to banks, increasing the minimum interest rate buffer to at least 3 percentage points (pps).

The move is expected to reduce the maximum borrowing capacity for the typical borrower by around 5%.

Wealthi co-founder Peter Esho said homebuyers and homeowners need to consider the wage growth first before committing to larger mortgages.

“The rise in the debt-to-income ratio is a concern and it should be watched closely. When property prices rise, we usually see loans, and some riskier loans start to rise as well,” he said.

According to the Australian Bureau of Statistics, the wage price index rose by a measly 0.7% over the December quarter versus the 4.7% growth in residential property price index.

“This has to be driven and matched by an increase in wages. So, we have to see if wages are increasing to ensure that affordability — and the ability to repay loans — will not be an issue.”

—

Photo by @tjump on Unsplash

Collections: Mortgage News

Share