The government guarantees under the First Home Loan Deposit Scheme (FHLDS) and New Home Guarantee provided support to a higher share of first-home buyers over the financial year 2021-2022.

According to the National Housing Finance and Investment Corporation’s (NHFIC) third FHLDS Trends & Insights report, around one in seven first-home buyers were supported by the Scheme in 2021-22, up from around one in 10 during 2020-21.

NHFIC head of research Hugh Hartigan said the growth in the share of first-home buyers being supported by the scheme demonstrate the boost the program provides.

“An interesting aspect of the report is that nearly half of all first home buyers typically purchased properties that were more than 25 years old, suggesting these types of properties provide a good entry point into the market for first home buyers,” he said.

Around 47% of the recipients purchased a dwelling that were more than 25 years old and tended to be around 18% cheaper on average than newly constructed dwellings.

Queensland was the standout state for FHLDS, experiencing the strongest demand for the scheme.

Around 29% of all places for the scheme were awarded to Queensland first-home buyers.

On top of this, a third of the recipients for the Family Home Guarantee during the same period reside in Queensland.

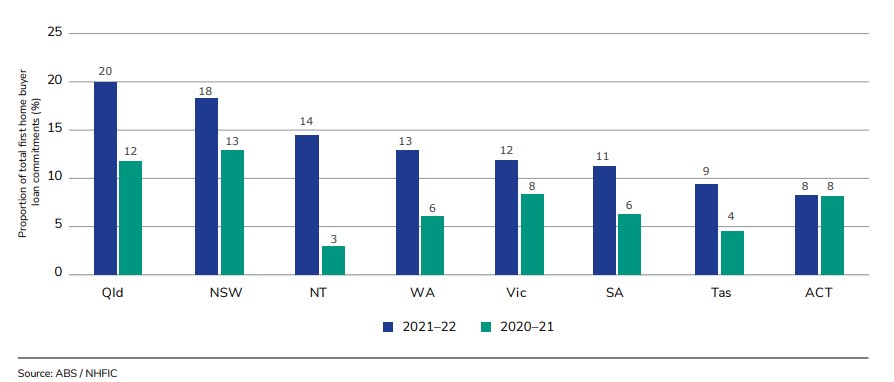

The graph below shows how the demand for the deposit scheme grew in each state and territory:

Meanwhile, the report showed that around 27% of all guarantees were issued to key workers — teachers and nurses accounted for more than half of the key worker recipients.

The report also found that homebuyers who were supported by the scheme typically purchases houses with three or more bedrooms.

Relative to the total first-home buyer loan commitments within each state and territory, Queensland still ranked the most popular state for the deposit scheme.

Around 20% of all first-home buyers in Queensland were given a boost by the scheme, up from 12% in the previous financial year.

-

Header photo by Valeriia Miller from Pexels.

Collections: Mortgage News

Share