Dwelling prices across Australia were still on a downtrend in September — the rate at which they are falling, however, appears to have already eased.

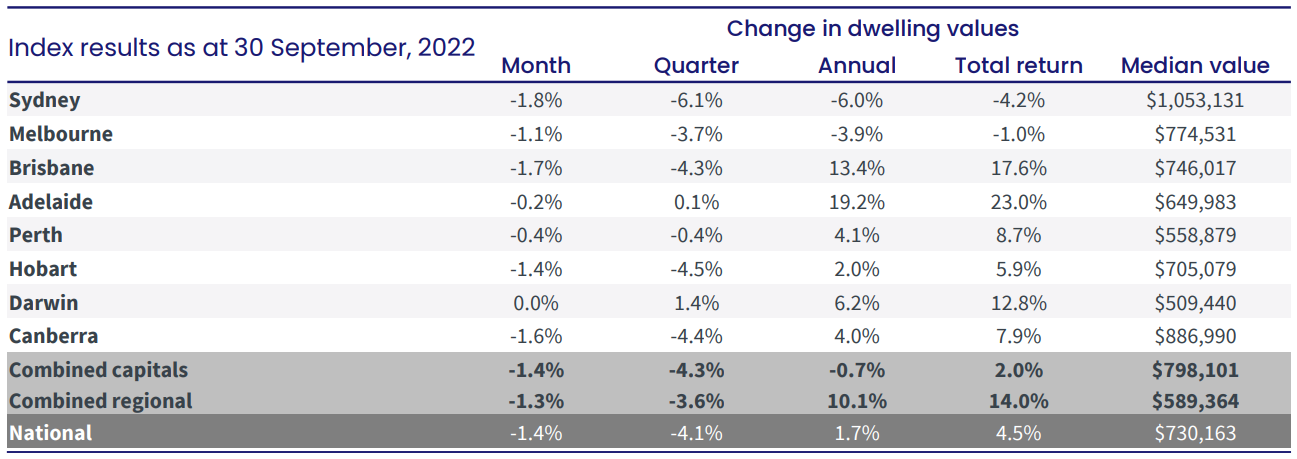

CoreLogic’s latest Hedonic Home Value Index showed a 1.4% decline in September, bringing the national median value to $730,163.

The decline in September was softer than in August, when values decreased by 1.6% monthly.

All capital cities, except Darwin which posted no movement in prices, still recorded a decline on a monthly basis, with Sydney and Brisbane leading the declines at 1.8% and 1.7%, respectively. Median prices across capital cities declined by 1.4%.

Regional markets also registered a fall, with median dwelling values down 1.3%.

CoreLogic research director Tim Lawless said the ease in the rate of decline does not necessarily mean that the market has already moved through the worst of the downturn.

“It’s possible we have seen the initial shock of a rapid rise in interest rates pass through the market and most borrowers and prospective home buyers have now ‘priced in’ further rate hikes,” he said.

“However, if interest rates continue to rise as rapidly as they have since May, we could see the rate of decline in housing values accelerate once again.”

On an annual basis, median dwelling values across most capitals are still higher in over the past month. Brisbane and Adelaide, for instance, still recorded double-digit median value gains.

However, annual figures show how much the downturn affected Sydney and Melbourne — they were the only state capitals to post an annual fall at 6% and 3.9%, respectively.

Mr Lawless said the slowing of price deceleration came with the improvement in other housing market indicators.

“Auction clearance rates also trended upwards, albeit subtly, in September and consumer sentiment nudged a little higher as well on the back of strong labour market conditions,” he said.

However, at a time when the flow of new listings is ramping up, the spring-selling seasons seemed to have started off slow.

In fact, the number of new properties added to capital cities over the four weeks ending 25 September was 12% lower than last year and 10% below the five-year average. Only Darwin and Canberra recoded a higher-than-average flow of new listings over the period.

“It seems prospective vendors are prepared to wait out the housing downturn, rather than try to sell under more challenging market conditions,” Mr Lawless said.

“We have not seen any evidence of distressed sales or panicked selling through the downturn to date; in fact, it has been the opposite, with the trend in newly listed properties continuing to diminish at a time when freshly advertised stock levels would normally be moving through a seasonal ramp up.”

Collections: Mortgage News Property News

Share