The Australian Capital Territory (ACT) posted the most robust growth in owner-occupier home loan commitments across all states and territories versus the decade average.

According to CommSec State of the States report, ACT achieved a 71.2% growth in housing finance compared to the decade average, hitting $549m in loans during the second quarter of the current year.

Victoria achieved the second highest gain at 64.9%, recording housing finance commitments of $6.5bn during the same period.

Quarterly Housing Finance – June 2022 Quarter |

||

|

State |

Value ($) |

Growth versus decade average (%) |

|

Victoria |

6.5bn |

64.9 |

|

ACT |

549m |

71.2 |

|

Tasmania |

297m |

46.1 |

|

Queensland |

3.98bn |

55.6 |

|

Western Australia |

1.99bn |

32.6 |

|

South Australia |

1.15bn |

45.8 |

|

New South Wales |

6.61bn |

49.6 |

|

Northern Territory |

95m |

6.2 |

Housing finance is just one of the eight indicators analysed by the report to determine the soundness of the states and territories’ economic standing over the quarter.

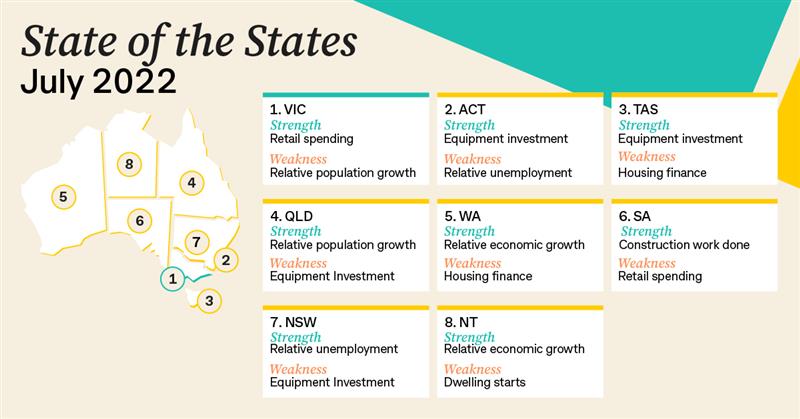

Overall, Victoria stood out as the best-performing state, closely followed by the ACT, Tasmania, and Queensland. Victoria broke the nine-quarter streak of Tasmania as the best-performing state.

CommSec Chief Economist Craig James said there is little to separate the top-performing economies during the quarter.

“Victoria leads the way on two of the eight economic indicators, but showing how even the rankings are, the ACT and South Australia also each lead other economies on two of the eight indicators,” he said.

Victoria ranked first in terms of retail spending and relative unemployment. Queensland, on the other hand, ranked first in terms of population growth.

The ACT performed the best in terms of equipment investment and housing finance.

Meanwhile, South Australia overshadowed everyone in terms of dwelling starts and construction work.

Western Australia hit the highest relative economic growth.

“In terms of future economic performance, much will depend on how economies are affected by growing COVID-19 case numbers and also how they respond to a period of rising interest rates," Mr James said.

Collections: Mortgage News

Share