It’s not all coming up roses for finance professionals, with bonuses remaining stagnant for many Aussies in the industry. How did their bonus activity compare to that of their counterparts elsewhere in the APAC region?

If the latest eFinancialCareers Bonus Survey are anything to go by, finance professionals in Hong Kong and Singapore are being remunerated more generously than the Aussies when it comes to bonuses.

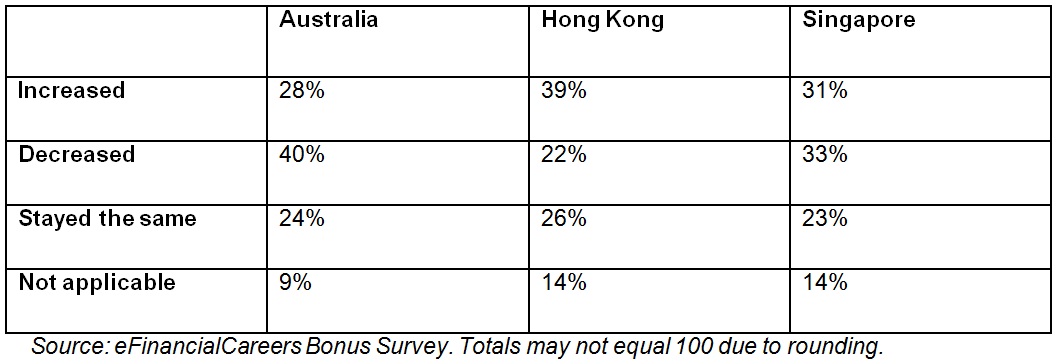

Only 28% of Australia-based finance professionals reported an increase in their 2012 bonuses, while the figure for Singapore was 31% and Hong Kong sat at 39%.

Results from the latest eFinancialCareers Bonus Survey reveals that less than three in 10 Australia-based finance professionals (28%) saw an increase in their 2012 bonuses, down from 34% in 2011. The results see Australian bonuses compare unfavorably in the Asia-Pacific region, with 39% of Hong Kong and 31% of Singapore finance professionals experiencing a bonus increase in 2012.

However, even though fewer Australia-based financial professionals received an increase in the 2012 bonus round, the average bonus payout was up 10% compared to 2011.

“Australian financial services firms, whilst remaining cost conscious, are this year more focused on just who in the firm receives a bonus. The trend is to move away from blanket bonuses and focus more heavily on rewarding top talent,” said eFinancialCareers Asia Pacific MD George McFerran. “It suggests firms are becoming more acutely aware of the need to retain their star performers.“

Additionally, 53% of those who received a bonus said it met or exceeded their expectations.

“The results point to Australia’s finance professionals being realistic in their expectations about the size of bonus payments for 2012, and undoubtedly the difficult trading conditions would have helped shape this view,” said Mr McFerran.

Collections: Mortgage News

Share