Your credit score is a bit like your appendix. You ignore it most of the time - you can even forget it exists. But, if it goes bad, it can cause major problems.

A poor credit score can bite when you're looking for a home loan, so it's important to be proactive and do everything you can to maintain or improve it.

What is a good credit score?

Credit bureaus will assign you a credit score based on the information handed to them by credit providers and the likes. Experian and illion provide scores of between 0 to 1,000, while that offered by Equifax goes up to 1,200.

The more reliable you are at meeting your financial responsibilities, the higher your credit score will probably be. The score is meant to give lenders an idea of how likely it is lending to you will result an 'adverse credit event', such as a default.

To give you a general idea of what a 'good' credit score is, here is the scoring system at Equifax, the largest of its kind in Australia.

Credit score Score rating What it means 0-459 Below average Equifax believes you're an above average risk for an 'adverse credit event' in the next year 460-660 Average You represent an average risk for an 'adverse credit event' in the next year 661-734 Good You're a below average risk for an 'adverse credit event' in the next year 735-852 Very good You're more than two times less likely than the average person to record an 'adverse credit event' 853-1200 Excellent You're about five times less likely than the average person to record an 'adverse credit event'

How to improve your credit score

If you’re concerned about your credit history and whether it might hurt your chances of getting a loan in the future, there are a few things you can do. You could check your credit report for errors, make a point to pay all your bills and loan or credit card repayments on time, and avoid applying for new credit products.

Here’s more on our top tips on how you might be able to improve your credit score:

1. Check your credit report for errors

If your credit score is lower than you would like and you're not sure why, it could be a good idea to closely review your credit report to ensure you recognise everything on it.

All providers who have given you credit will relay related information to the credit bureaus - Equifax, illion and Experian. But credit providers and reporters can make mistakes.

If you spot any errors on your report, it's best to make contact with the reporting agency to ask if you're able to have it fixed.

How to check your credit score

You can usually check your credit score and report by contacting one of the credit reporting agencies for a copy.

Typically, it's free to check in on your credit once every three months, but you might need to pay to receive a comprehensive report.

2. Pay your bills and meet your repayments

Your credit score is derived from your history of repaying debts and bills.

So, a simple way to protect your credit is to make sure you pay your bills, your credit card balance, and your loan repayments on time, every time.

A repayment that's late by more than 14 days can hurt your credit score for up to two years, while a default (a repayment that's late by over 60 days) can leave a dent for as many as five years.

3. Don't make too many enquiries

A string of enquiries for credit products can hurt your credit score. That's because it can appear that you're applying for many finance products and getting declined for most, if not all.

If you've made an application for a credit card, car loan, personal loan, or home loan, the lender you applied to might have enquired about your credit score. If it did, it's enquiry might be recorded on your credit report.

See also: Home Loan Eligibility Criteria

4. Wait patiently

Your credit history doesn't reach back forever.

There's generally a set amount of time for which certain bits of information stay on file. Once that time is up, it's removed from your report.

Small mistakes are often wiped from the record after a few years, while big ones will typically only remain for seven years

So, if your credit score is lower than you need it to be, you could simply sit back and wait for late repayments or defaults to retire from your report. In the meantime, ensure you're making responsible financial decisions.

How long can it take to improve your credit score?

Here's how long some of the big stuff stays on record for:

Bankruptcy: Your bankruptcy will remain on your credit history for five years from when you were declared bankrupt, or two years from when you were no longer bankrupt, whichever is longer

Court judgement: If a court decides you owe money, it will stay on your credit report for five years

Credit enquiry: A credit enquiry - that is, an enquiry performed by a financial institution as it determines whether or not to lend to you - stays on your record for five years

Credit obligation: Details of any credit obligation stay on your record for two years after you've paid it off. For example, if you paid a personal loan off a few months ago, chances are it will still be on your record in 18 months' time

Credit default: If you've been more than 60 days overdue on a repayment, it will be on your credit report for five years after the fact

Serious credit infringement: A serious infringement - this could mean you've had an unpaid debt and changed your address without informing your creditor, for instance - stays on your credit report for seven years

5. Consider credit repair services

If you're unhappy with your credit score and overwhelmed at what it might take to correct it, you could consider enlisting a credit repair lawyer to help.

They might be able to identify specific things on your report hurting your score that could be taken off by engaging with the provider. Keep in mind, though, that credit repair lawyers aren't a charity - you'll need to pay for their services.

Further, it may be the case that they can only remove errors from your credit report, not legitimate enquiries, defaults, or late repayments.

Of course, you might be able to have errors contained in your credit report corrected yourself by contacting the reporting agency.

Thinking about taking out a home loan? Here are some of the best mortgage deals with 95 LVR on the market right now:

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.29% p.a. | 5.33% p.a. | $2,773 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.19% p.a. | 5.20% p.a. | $2,742 | Principal & Interest | Variable | $0 | $180 | 80% | |||||||||||||

5.89% p.a. | 6.16% p.a. | $2,962 | Principal & Interest | Variable | $0 | $790 | 98% | |||||||||||||

5.89% p.a. | 5.95% p.a. | $2,962 | Principal & Interest | Variable | $0 | $799 | 95% |

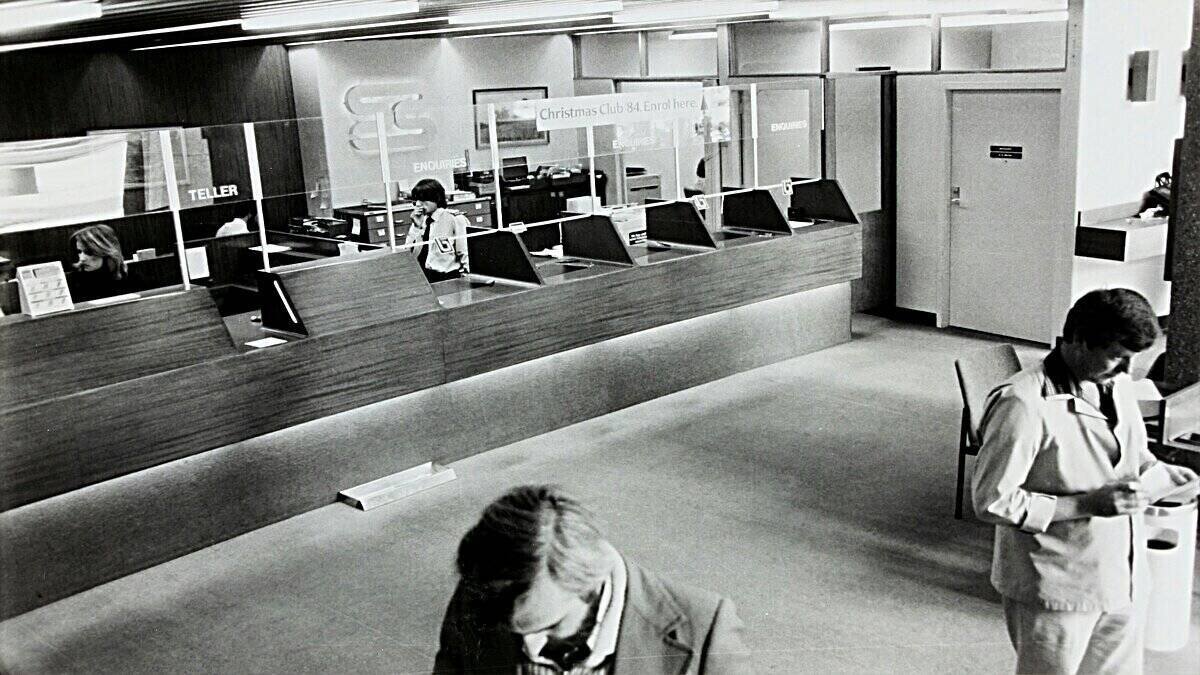

Header Image by Museums Victoria. Receipt picture by Joao Viegas, lawyer picture by Hunters Race, both accessed on Unsplash

Collections: Borrowing Power

Share