First-home buyers who are opting to pay for an annual land tax will be able to pay less significantly based on the typical holding periods, according to the latest study from the NSW Treasury.

The study found that about two-thirds of first-home buyers in the $800,000 to $1.5m price range are expected to choose the First Home Buyer Choice as it would lower their overall tax payments.

The First Home Buyer Choice is a program by the NSW government as part of its integrated multi-billion-dollar housing package under the 2022-23 Budget.

Under the initiative, the property tax option will be available for properties for up to $1.5m. The high property threshold will ensure that the scheme will help a broader group of aspiring first-home buyers.

First-home buyers who opt into the property tax will pay an annual property tax of $400 plus 0.3% of the land value of the property.

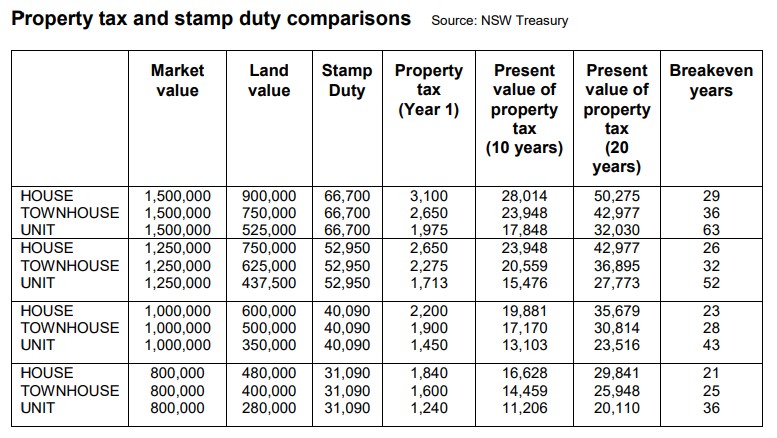

According to Treasury’s calculations, the breakeven period between upfront stamp duty and annual property, under reasonable assumptions, would be 36 years for an $800,000 apartment, 28 years for a $1m townhouse, and 26 years for a $1.25m house.

NSW Treasurer Matt Kean said the First Home Buyer Choice will not only help first home buyers get the keys to their home sooner but will also result in many first home buyers paying less overall.

“It is all about choice, and for many first home buyers choosing to make a smaller annual payment will save them money in the long run,” he said.

For instance, if a buyer purchased a $1m house and sold it 10 years later, the annual property payments would total $19,881, significantly lower than the $40,090 stamp duty.

“Most people purchase a home more than once during their lives, so it will make sense for many first home buyers to choose a smaller annual fee for the limited time they spend in their first property, rather than a lump sum of stamp duty,” said Mr Kean.

Here’s a table of comparison between land tax and stamp duty for each market value level and dwelling type:

The initiative is set to be legislated before the NSW Parliament next week.

Applications for the initiative will be open starting 16 January 2023 — by this time, first-home buyers can opt-in to property tax instead of paying for stamp duty upfront.

Buyers who are buying a property from someone who is paying land tax will not be subject to the same scheme unless they are also first-home buyers and are planning to apply for the scheme.

NSW recently rolled out a calculator that provides a detailed comparison of the options available for first-home buyers.

—

Photo by 89Stocker on Canva.

Collections: Mortgage News Stamp Duty

Fact checked

Fact checked

Share