NSW Government’s historic First Home Buyer Choice legislation officially passed in Parliament — starting 12 November, first-home buyers can now choose to pay a smaller annual property tax instead of a large upfront stamp duty.

State Treasurer Matt Kean said the new law would help more young people enjoy the financial security that comes with home ownership.

“First Home Buyer Choice will significantly reduce upfront costs, reduce the time needed to save for a deposit and will see the majority of eligible first home buyers paying less tax overall,” he said.

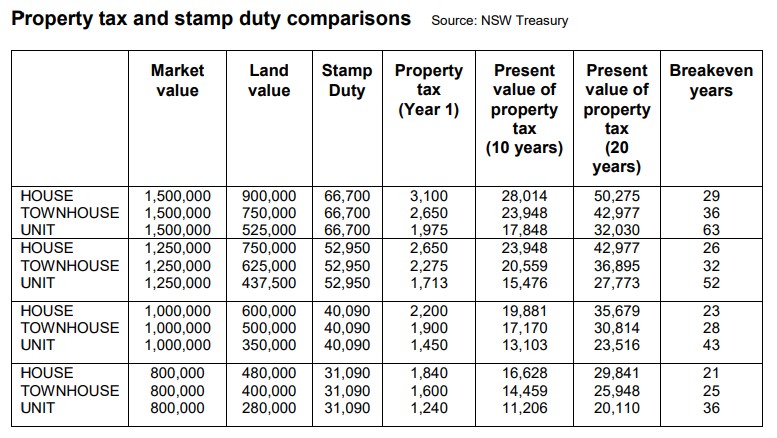

A study from the NSW Treasury showed that around two-thirds of first-home buyers in the $800,000 to $1.5m price range are expected to choose the First Home Buyer Choice as it would lower their overall tax payments.

Aus Property Professional founder and Buy Now author Lloyd Edge said the stamp duty reforms will encourage them to buy more expensive properties.

"Usually, first home buyers limit themselves to properties under $650,000 to avoid paying stamp duty," he told Your Mortgage.

"However, these changes will likely result in a greater number of first home buyers starting to purchase $1m+ properties, especially in Sydney, where property is very expensive relative to the rest of NSW — this means that investors might be able to get cheaper properties at a better price point.

Mr Edge said while these changes would not push house prices up too much, as the increasing rates are still limiting the borrowing capacities of many would-be buyers.

Eligible first-home buyers can access the scheme starting 12 November.

However, while these buyers will be required to pay stamp duty on purchases made until 15 January 2023, they will be able to apply for a refund if they choose to opt into the annual fee.

From 16 January 2023 purchasers can opt into the annual fee directly and will not be required to pay stamp duty.

The scheme will be available for dwellings with values of up to $1.5m.

For the purchase of vacant land for the purpose of building a first home, the price cap will be up to $800,000.

According to Treasury’s calculations, the breakeven period between upfront stamp duty and annual property, under reasonable assumptions, would be 36 years for an $800,000 apartment, 28 years for a $1m townhouse, and 26 years for a $1.25m house.

If a first-home buyer got a $1m house and sold it 10 years later (which is the median holding period), the annual property payments over the period would only be around $19,881, significantly lower than the upfront stamp duty cost of $40,090 for the same property.

To help first-home buyers compare their savings, NSW rolled out a calculator on the Service NSW website that shows how much each of the option would cost.

—

Photo by studioroman on Canva.

Collections: Mortgage News Stamp Duty

Fact checked

Fact checked

Share