Just because you're not in a position to buy a house doesn't mean you can't benefit from a booming market. Investing in Real Estate Investment Trusts (REITs) can give you exposure to the property sector, even if you only have a few hundred dollars to invest.

What is REIT investing?

REITs, or real estate stocks, are investment vehicles that hold multiple commercial or residential properties, or a mix of both. Investors can buy shares in REITs on the ASX or international stock markets and, if the value of a trust's properties increases, their share price will likely go up, just like companies listed on the stock market. If the properties owned by the trust earn income, investors may also receive dividends.

How much do you need to invest in real estate stocks?

The share price of REITs can vary. For example, at the time of writing the price of the Goodman Group REIT (ASX: GMG) is about $34 AUD while the Scentre Group (ASX: SCG) share price is just over $4. However, the Minimum Marketable Parcel (MMP) rule applies to REITs, which means your first purchase of any listed security must be valued at $500 or more. Depending on how you buy and what REITs you invest in, there might be other minimum investment rules but generally you can get started with a few hundred dollars.

How much can you earn from REITs in Australia?

As you're probably well aware, property values in Australia have gone up dramatically over the past few years, which means REITs have also trended upwards.

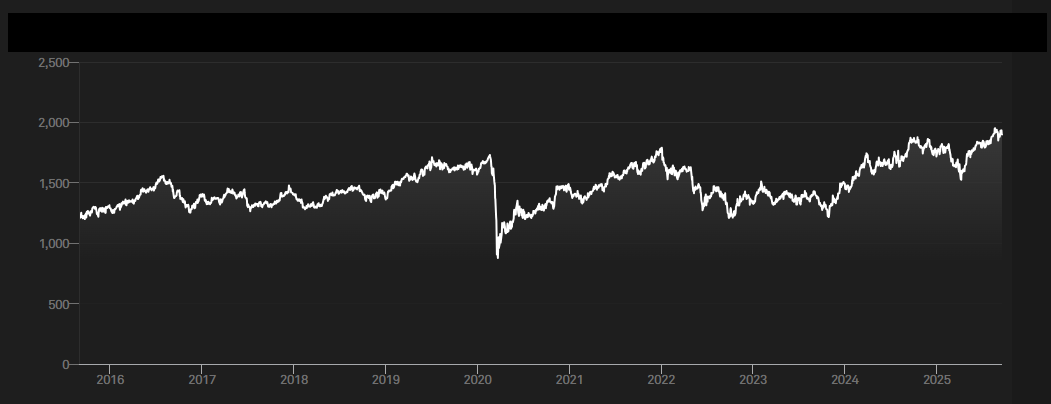

In August 2015 the ASX 200 index for REITs was at about 1240 points. By mid-September 2025, it was at just under 1900 points, which equals a return of about 53% over the decade. However, that's nearly double what the index was when it bottomed out at the height of the pandemic - and (of course) past performance doesn't guarantee future performance.

The S&P/ASX 200 A-REIT performance since 2015

What is a mortgage REIT?

While we've used REITs as a general term so far, what we've really been referring to so far is equity REITs - entities that buy and hold properties. Most REITs in Australia are like this but, as of September 2025, there are also two mortgage REITs listed on the ASX. Instead of buying properties themselves, a mortgage REIT buys and sells mortgages or mortgage backed securities, earning income from the interest.

What are the advantages of investing in real estate stocks?

Spread exposure

Investing in real estate stocks allows you to diversify not only across many different properties, but also different sectors. REITs often hold a mixture of properties that might include office blocks, industrial space, retail, farmland - you get the idea. Like investing in mutual or exchange traded funds over individual stocks, investing in REITs means spreading exposure so you aren't vulnerable to one specific asset losing value.

Low barriers to entry

Buying even an entry level property in Australia these days will likely cost several hundred thousand dollars. Saving up for a deposit and paying off a mortgage over 20 or 30 years is among the biggest challenges and ongoing expense of most people's lives. You can get sometimes started investing in REITs with just a few hundred dollars.

Passive dividend income

Many REITs distribute a percentage of their rental income to investors in a mechanism similar to how companies might pay dividends. These can be a useful passive income stream and, given commercial property often has higher rental yields than residential property and REIT investors needn't worry about paying for upkeep or maintenance, the margin between income and expenses on REITs may be higher than for most property investors.

What risks should be considered when investing in real estate stocks?

More modest returns than buying individual property

As you'll note from the chart above, REIT returns tend to be steady than spectacular. Over the ten years to 2025, the 20 REITs in the ASX 200 index for REITs returned just over 50%. Over the same period there have been many examples of specific properties doubling or even tripling in value.

Market volatility

As REIT shares are traded daily, the price can be more volatile than property prices. Even if the underlying properties aren't changing much in value, the REITs shares can go up or down significantly.

Other fractional real estate investing options

If you like the idea of owning a portion of a property, there are other investment options beyond REITs.

Unlisted property funds

There are other funds beyond the REITs listed on the ASX that also pool investor money to buy property. Investing in these typically means investing directly with a fund manager, often with a trust structure, instead of buying shares on an exchange. Shares in unlisted funds might offer less volatility than listed REITs but may also have higher barriers to entry with less liquidity.

Fractional property platforms

Digital platforms like BrickX allow investors to buy units in a specific property or a pool of properties. Generally, the platform itself buys the properties then issues fractional interests which investors can buy to receive a share of net rental income. These platforms have similarly low barriers to entry to REITs but investments might be more concentrated, in just a few or even a single property.

Property syndicates

The option that's perhaps the easiest to understand is just to go in on a property with a group of people. This might be buying a house with friends or a more formal syndicate with a trust manager. This option can be lucrative if the property in question increases in value significantly, but unless you sell your stake to someone else, you won't be able to withdraw your money until the syndicate decides to sell the property.

Read more: Pros and cons of buying property with family or friends

Photo by lionvision on Canva

First published in June 2023

Collections: Property Investment

Share