Property investors in Victoria are poised to see higher rents this year as vacancy rates sink deeper.

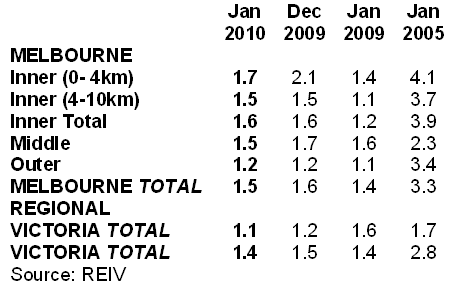

The number of rental properties available in the market has fallen to 1.4 % in January from 1.5% in December 2009 according to the Real Estate Institute of Victoria (REIV).

Properties located in the outer ring of Melbourne recorded the lowest vacancy rate of 1.2%, while the middle ring suburbs saw a drop to 1.5% from 1.7%.

Regional Victoria recorded the lowest vacancy rate of just 1.1% compared to Melbourne's 1.5%.

The rental market in Melbourne has progressively tightened over the past five years, resulting in higher rents according to REIV CEO Enzo Raimondo.

"The last time the vacancy rate was above 3% was in January 2005. Since that time rent increases have grown from 3% per year to around 10%. There are two reasons for this, over the past five years the rate of population growth has doubled and the supply of housing has not increased at the same rate."

"Conditions in regional Victoria are equally difficult- January marks the sixth month in a row that the regional Victoria vacancy rate has been lower than Melbourne's," noted Raimondo.

Collections: Mortgage News

Share